Reverse educators take on more HECM misconceptions

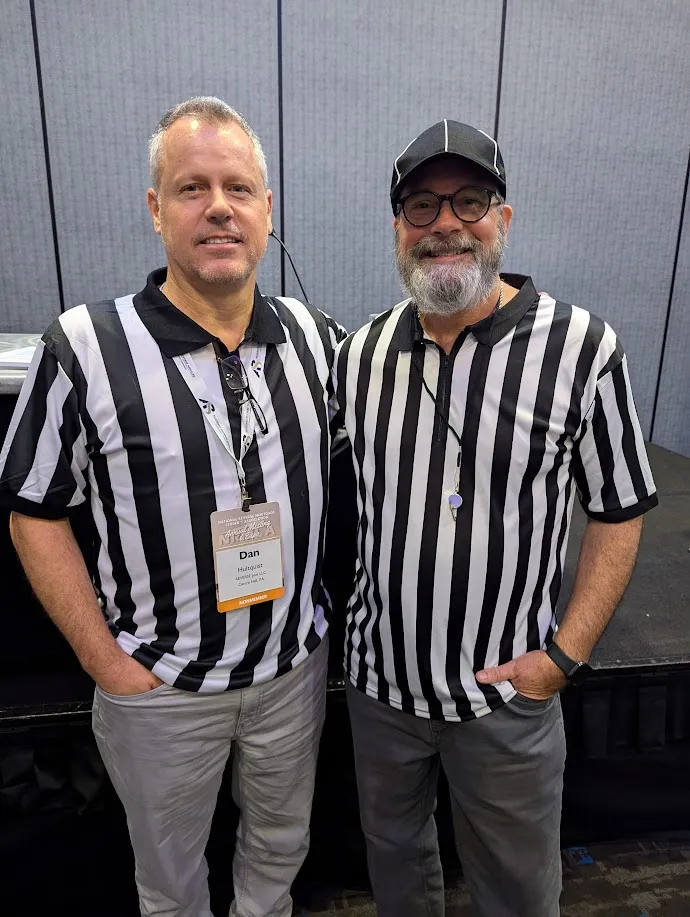

Reverse mortgage educators Dan Hultquist and Jim McMinn brought their “Rules of the Game” presentation back to the National Reverse Mortgage Lenders Association (NRMLA) Annual Meeting and Expo this year in San Diego. After getting some of the preliminaries out of the way regarding the importance of focused information, they drilled deeper into certain topics related to reverse mortgage product features.

The popular presentation is very interactive and features the presenters wearing referee shirts. In a change of pace from prior years, the “fouls” on certain incorrect example statements were called by members of the audience — who were equipped with their own whistles.

Line of credit

One such misconception touched on during the event focused on the Home Equity Conversion Mortgage (HECM) line of credit feature.

“Hello, Mrs. Smith,” McMinn began, playing the role of a reverse mortgage originator. “I understand you’re looking for clarification on the line of credit growth. It’s similar to the interest you earn on a bank account. …”

The sentence was immediately interrupted by the shriek of a whistle, which surprised even the presenters themselves.

“That’s not a good representation of the line of credit,” Hultquist said. “It’s mortgage growth, not income. We’re basically going to blow the whistle on some things we say in the industry — the line of credit growth is not income.”

Hultquist remembered walking through Midway Airport in Chicago when he received a call from an industry contact asking for his help to explain “how the line of credit earns interest.”

“Yeah, that’s not exactly accurate,” he replied. Income, he explained, is generally taxed and doesn’t need to be repaid unlike loan proceeds.

“I prefer to talk about cash flow instead of income in our space,” he said. “But the line of credit growth? It’s not ‘earning’ anything.”

He offered the example of calling up a credit card company ahead of a shopping spree and asking them to extend an existing credit line by an additional $1,000. When that happens, a person is not earning $1,000.

“Keep that in mind. It’s simply the greater capacity to borrow more money in the future, regardless of your property value,” he said.

The U.S. Department of Housing and Urban Development (HUD) also advises counselors — although this applies to originators as well — that the line-of-credit growth is simply “increased access to borrowing power,” he said.

‘Tax-free’ money

McMinn continued with another mock call as a reverse mortgage originator.

“Hi, Mr. Moore,” he began. ”The last time we spoke, we were discussing the financial planning strategies of the reverse mortgage. One of the key advantages we discussed is that the reverse mortgage offers you tax free …”

Once again, the sound of a whistle tore through the meeting room.

This misconception often gets to the root of language that can be found in some reverse mortgage industry advertisements. But there needs to be a visible asterisk next to any claim of “tax-free cash” or “tax-free money,” Hultquist said.

“It would be OK to say that disbursements are not taxed as income, from my perspective — again, I’m not a compliance officer or an attorney — but disbursements are not taxed as income in any state,” Hultquist said with clarification. “But you better put ‘generally’ or ‘typically,’ or whatever caveat, just in case.”

A reverse mortgage itself is not a tax-free financial instrument, he explained. He referred to a recent move in Florida, where state tax stamps were reduced following legislation signed into law in May.

“And intangible tax, depending on who you talk to or what county in Florida, may be taxed at a higher level,” he added.

“So, there are significant taxes you’re going to pay to get a reverse mortgage, or any mortgage,” he explained. “Things like intangible tax, state tax — interest on drawn funds could be taxable. And in rare cases, there might be capital gains taxes. So, there aren’t a lot of taxes you pay to get a reverse mortgage, but the CFPB’s primary concern is that there are taxes you have to pay after a reverse mortgage, like property taxes.”

The Consumer Financial Protection Bureau (CFPB) has taken action against players in the reverse mortgage space for not making this more explicit. Advertising “tax-free” money without mentioning the requirement of the HECM program to keep paying property taxes, homeowners insurance and other potential obligations (like HOA fees) could be considered deceptive, Hultquist explained.

Categories

Recent Posts